5 Steps to Become a Bookkeeper – USA TODAY Classifieds

The Open University has 50 years’ experience delivering flexible learning and 170,000 students are studying with us right now. While there is one gold standard accounting certification in the United States (CPA), there isn’t a bookkeeping equivalent. They take the data of the bookkeeper and verify it, analyze it, and turn it into understandable information like reports. They provide guidance and strategy, and help better understand the past and the future of the company. When you know which accounts to track and have the right tools in place, bookkeeping can be a breeze and not a headache.

Online education is a great choice if you have already started your career and want to branch out, or if you live very far away from schools offering the program you need. Before you commit to a program, just make sure that the school you are considering is accredited.

In a post on Accounting Web Foster says there are still many opportunities and bookkeeping doesn’t need to suffer. The bookkeepers just need to know their market and attract the clients that value their skilled contribution. A high school diploma is the minimum educational requirement needed in order to become a bookkeeper. While enrolled in high school, you need to take courses related to mathematics, computers, accounting, and English. This will lay the necessary groundwork to pursue training at the next level or find employment.

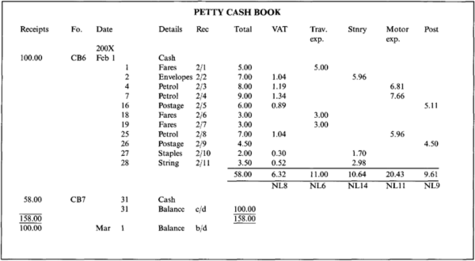

bookkeeping requires knowledge of debits and credits and a basic understanding of financial accounting, which includes the balance sheet and income statement. For example, QuickBooks (from Intuit) is a low-cost bookkeeping and accounting software package that is widely used by small businesses in the U.S. Conestoga College offers a one-year certificate program that prepares students to perform bookkeeping and managerial accounting tasks in a traditional manner and through the use of accounting software. Students become competent in a variety of bookkeeping and accounting software programs.

These bookkeeping organizations offer various programs to help you attain the bookkeeping level of mastery you choose. If you answered yes, then bookkeeping could be the perfect job for you. Check out the various online and in-person bookkeeping programs and certifications in your area. From the smallest mom-and-pop stores to big name chains, every business needs a bookkeeper.

Foster says there is a strong feeling that desktop software will stagnate and no longer be developed or supported in the long term and that technology will result in a falling income for bookkeepers. After being hired, employers often provide an extensive job training process with new bookkeepers. Paired up with an experienced bookkeeper, new employees will observe work policies and learn how to perform the necessary operations associated with bookkeeping. Each employer will have different policies or methods for conducting work, so it is important that bookkeepers learn how the work is performed.

QuickBooks-Training.net

Some online bookkeeping courses are free, while some require payment. The Canadian Institute of Bookkeeping (CIB) is a nonprofit organization that offers professional development programs in a variety of bookkeeping disciplines. Today’s business world means you might face a new challenge daily, as the business environment is ever-changing.

There is usually at least one account for every item on a company’s balance sheet and income statement. In theory, there is no limit to the number of accounts that can be created, although the total number of accounts is usually determined by management’s need for information. We believe that Bookkeeping and accounting is a very important part of every business. Flatworld Solutions has been in this domain for over 16 years now and has served several clients across the world.

- Speaking up and giving your take on a situation provides valuable perspective.

- You may wish to get business liability coverage, professional liability (errors and omissions) coverage, valuable papers and records coverage, data breach coverage, etc.

- Accountants, though not formally required to do so, traditionally acquire their CPA certification as well as their Master’s degrees.

- Bookkeeping enables the small business owner to support expenditures made for the business in order to claim all available tax credits and deductions.

- There are lots of online tutorials that will help you learn the basics.

- Bookkeepers often get paid hourly wages rather than annual salaries.

This is a bachelor’s degree plus 30 hours of graduate work; most CPA candidates go ahead and finish their master’s degrees. Bookkeepers who work for multiple firms may visit their clients’ places of business. They often work alone, but sometimes they collaborate with accountants, managers, and auditing clerks from other departments. If you’re already an experienced bookkeeper, the answer may be “no”. A big question is whether bookkeepers are as regulated as accountants.

Your go-to source for weekly updates on accounting and financial news. In order to protect their income, bookkeepers should consider value pricing and pricing models using fixed retained rates, he advises.

Take a Look at Kelly Perry’s Bookkeeper Launch Experience

Look at postings for jobs near you and find out if that’s the case for businesses in your area. If so, it might be worth the investment to go back to school so that you can make yourself more marketable. Many bookkeeping and accounting offices are willing to let high school or college students work part-time as interns.

At a basic level, bookkeepers manage transactions brought in through software, like an app. Bank feeds, that link the software with your business bank account, allow you to see each transaction in real-time.

There are various prerequisites depending on the exact program you enrol in, but you may be able to test out of many of these prerequisites based on prior experience. After you complete your course(s), you receive a Certificate of Achievement that acknowledges your academic accomplishments.

If your company sells products or services and doesn’t collect payment immediately, you have “receivables,” or money due from customers. You must track Accounts Receivable and keep it up to date so that you send timely and accurate bills or invoices.

If you’re more of an “outdoors” person who hates sitting in front of a PC for extended hours looking at numbers and figures, bookkeeping might not be for you. No one likes to send money out of the business, but a clear view of everything via your Accounts Payable makes it a little less painful. Concise bookkeeping helps assure timely payments and avoid paying someone twice! As the business owner, if you don’t understand the different types of “accounts” your bookkeeper uses to organize your finances, measuring the success (or failure) of your efforts will be futile.